Marine insurance provides comprehensive coverage:

Covered risks under marine insurance:

Benefits of marine insurance:

- Protection against loss or damage to goods during transportation, giving businesses financial security and peace of mind.

- Coverage for liability claims if the transported goods cause damage to third parties or property.

- Mitigation of potential financial losses caused by accidents or mishaps during transportation.

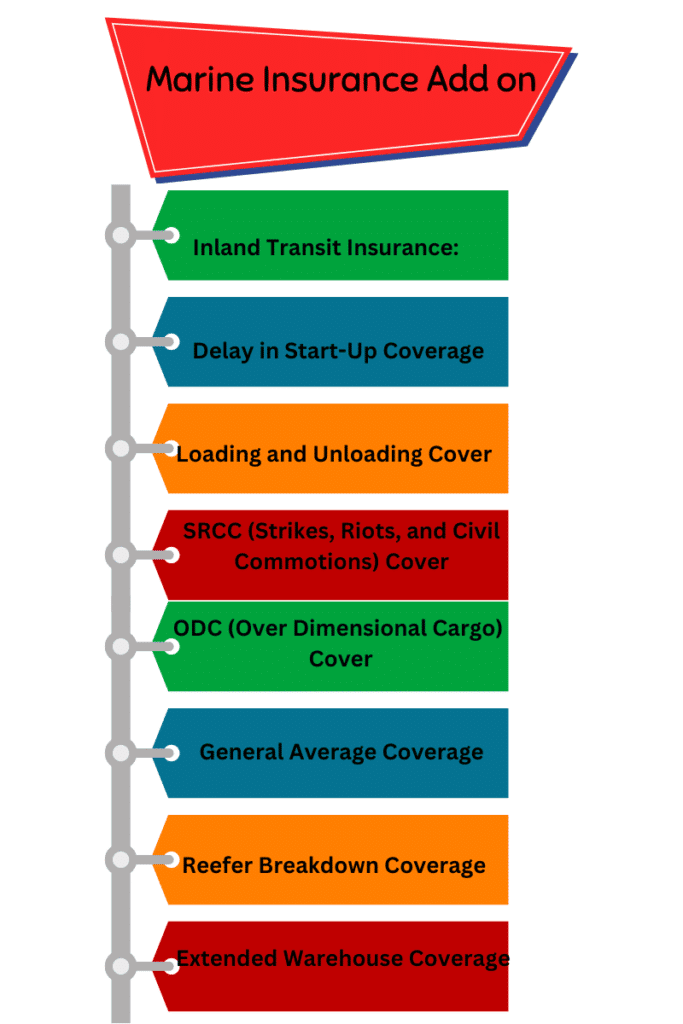

Additional coverage options (add-ons):

Inland Transit Insurance:

War and Strikes Coverage:

Delay in Start-Up Coverage:

Loading and Unloading Cover:

SRCC (Strikes, Riots, and Civil Commotions) Cover:

ODC (Over Dimensional Cargo) Cover:

General Average Coverage:

Extended Warehouse Coverage:

Reefer Breakdown Coverage:

These additional add-ons enhance the coverage provided by marine insurance, ensuring businesses have comprehensive protection for their goods throughout the transportation journey. By including loading and unloading cover, SRCC cover, and ODC cover, businesses can further mitigate risks and secure their assets during the transportation process.

⇾ Example: Mayank, an iron trader, benefits from marine insurance when his truck is involved in an accident on the road. The insurance policy covers the repair costs of the truck and compensates for the damaged cargo, ensuring financial stability for Mayank’s business.

Main Steps to Choosing the Right Marine Insurance for Indian Businesses.

Determine the Type of Transport:

Consider the Type of Goods:

Assess the Type of Packing:

Verify the Knowledge of Broker/Agent:

Review the Broker/Agent's Past Claim Settlements:

Assess the Need for ODC Cover:

Evaluate the Need for Temporary Warehouse Cover:

Consider the Settlement Process of the Chosen Company:

By following these steps and considering these factors, Indian businesses can select the right marine insurance policy that aligns with their specific transportation requirements and provides comprehensive coverage for their goods.

⇾ Here are some additional resources that you may find helpful:

- The Insurance Regulatory and Development Authority of India (IRDAI): https://www.irdai.gov.in/

- The Federation of Indian Chambers of Commerce and Industry (FICCI): https://www.ficci.in/

- The Confederation of Indian Industries (CII): https://www.cii.in/

Conclusion

- Assess the type of transport used for goods.

- Consider the nature and value of the goods being transported.

- Evaluate the packing methods employed to protect the goods.

- Verify the knowledge and expertise of the broker/agent.

- Review the past claim settlements handled by the broker/agent.

- Determine the need for Over Dimensional Cargo (ODC) cover.

- Evaluate the need for temporary warehouse cover.

- Consider the efficiency of the chosen company’s claim settlement process.

⇾ Taking these factors into account ensures that businesses have adequate coverage and protection throughout the transportation journey. By choosing the right marine insurance policy, businesses can mitigate risks, safeguard their goods, and gain peace of mind. It is crucial to thoroughly assess and understand the terms and coverage options to make an informed decision.

Frequently Asked Questions : Marine Insurance

Marine insurance is a type of insurance that provides coverage for goods, cargo, or vessels during sea or inland waterway transportation against risks such as damage, loss, or theft.

You can buy marine insurance from insurance companies or insurance brokers who offer marine insurance policies. They will guide you through the process and provide you with the necessary details and options.

The best marine insurance depends on your specific needs and requirements. It is advisable to compare policies from reputable insurance companies, considering coverage, premiums, and customer reviews to determine the best option for you.

Some well-known marine insurance companies in India include New India Assurance, National Insurance Company, ICICI Lombard, HDFC Ergo, and Oriental Insurance. Research and reviews can help you select the best company for your needs.

Cargo marine insurance provides coverage specifically for goods or cargo being transported via sea or inland waterways. It safeguards against risks such as damage, loss, or theft during transit.

In-transit marine insurance covers goods or cargo during transportation from one location to another, whether it’s by sea, air, road, or rail. It protects against various risks that may occur during transit.

Key features to consider when buying marine insurance include coverage for various risks, including damage, loss, and theft; flexibility in policy options; a reliable claims settlement process; and competitive premiums.

Even for domestic shipments within India, marine insurance is recommended to protect against unforeseen risks and ensure financial security in case of any loss or damage during transit.

Yes, marine insurance can provide coverage for vessels or boats against risks such as damage, loss, or third-party liability during their operations or while being transported.

Marine insurance is not legally mandatory for international shipments, but it is highly recommended to mitigate risks and safeguard your goods against potential losses during the journey.

It depends on the terms of the agreement with the seller. It is advisable to clarify the insurance coverage with the seller before the shipment to ensure adequate protection for your goods.

Yes, insurance companies often provide the flexibility to customize marine insurance policies to suit specific cargo types, transportation methods, or additional coverage requirements.

To buy marine insurance, you may need to provide documents such as the invoice for the goods, details of the cargo, transportation documents, and identification documents as required by the insurer

Yes, many insurance companies offer the convenience of purchasing marine insurance online. You can visit their websites, provide the necessary details, and complete the buying process digitally.

Marine insurance typically covers losses caused by natural disasters, accidents, theft, or other covered perils. However, it’s essential to review the policy terms and conditions to understand the specific coverage.

Some marine insurance policies may offer optional extensions or add-ons to provide additional coverage for specific needs. You can discuss this with the insurance provider while buying the policy.

Without marine insurance, you may have to bear the financial burden of the loss or damage to your goods. Having marine insurance provides financial protection and peace of mind in such situations.

Yes, you can cancel your marine insurance policy; however, terms and conditions for cancellation may vary depending on the insurance company. It’s advisable to check the policy details or consult with the insurer.

The time taken to settle a marine insurance claim can vary depending on the complexity of the claim and the cooperation between the insured and the insurance company. It is best to discuss the expected timeline with the insurer.

Premiums for marine insurance can be influenced by factors such as the type of goods being transported, the mode of transportation, the distance covered, the insured value of the cargo, past claims history, and any additional coverage options.

Yes, most marine insurance policies can be renewed upon expiration. It is advisable to contact your insurance provider to discuss the renewal process and any updated terms or conditions.

The decision to purchase marine insurance directly from the insurance company or through a broker depends on your preference and comfort level. Direct purchase allows direct communication, while brokers can offer guidance and access to multiple insurance options.